Sustainability and Climate Risk Certification (SCR®) Training Program (Synchronous e-learning)

17 February 2024 to 13 March 2024

Sustainability and Climate Risk Certification Training Program (Synchronous e-learning) has reached the maximum number of registrations. Subscribe to our mailing list for updates on the next run of the course (TBC). Click here to subscribe.

Course Description

Climate risk and Sustainability are fast gaining importance in today’s financial world because of the global agenda on climate change and efforts to reduce Greenhouse gas (GHG) emissions internationally. These follows the Paris agreement on climate change in 2015 and the alliances formed at COP26 @Glasgow more recently. Indeed, climate risk is an emerging ‘new’ risk class in financial institutions because of indirect dire impact from transition risk and physical risks. Importantly regulators (such as the Monetary Authority of Singapore (MAS)) are drafting the standards and reporting requirements for this new emerging risk class to be measured, controlled, and disclosed. In terms of global banking regulations, climate risk is fast making its way into industry-wide stress tests, accounting standards, and potentially Basel capital.

The Risk Management Institute (RMI)’s Sustainability and Climate Risk (SCR®) exam preparation course is designed to align with Global Association of Risk Professionals' (GARP) SCR certification objectives and examination structure.

There are following 8 chapters in the latest (2023) SCR certificate covering aspects of sustainability and climate risk management. This RMI training program is composed of 7 sessions of 3 hours each. There will be a quiz at the end of the course which mirrors the format, coverage and standards of the actual SCR exam syllabus.

Chapter 1: Foundations of Climate Change: What Is Climate Change

Chapter 2: Sustainability

Chapter 3: Climate Change Risk

Chapter 4: Sustainability and Climate Policy, Culture, and Governance

Chapter 5: Green and Sustainable Finance: Markets and Instruments

Chapter 6: Climate Risk Measurement and Management

Chapter 7: Climate Models and Scenario Analysis

Chapter 8: Net Zero

What Is the SCR Certificate?

The SCR Certificate is an entry into a fast-growing community driving the future of climate risk management. From entry-level to executive, across industries such as banking, fintech, hospitality, fashion, and more, SCR Certificate holders are leading their companies with solutions to today's top issues in climate change and sustainability.

Professionals who complete their SCR Certificate will:

- Develop strategies for improving climate risk mitigation efforts

- Learn how to tackle today’s physical and transition risks

- Get a real-world look at climate change’s economic impact

- Lead firms to invest sustainably and create meaningful change

Course Objectives

- The course will equip students to take the SCR exam certified by GARP. A certified student is expected to have a broad knowledge of sustainability and climate risk.

- This knowledge will allow the student to gain entry employment into areas such as green finance, Environmental-Social-Governance (ESG) indexing, sustainability consulting, governmental /non-governmental advocacy, financial institution's climate risk management, sustainability reporting & governance, carbon credit markets, etc.

- The subject will be extremely relevant and timely as the financial industry, listed companies & regulators are embracing climate change and the green agenda rapidly, driven by regulatory requirements. We expect a sharp increase in green workforce and a competency gap and increased need for these emerging skills set. This knowledge base is multi-disciplinary-- combining science, finance, and advocacy-- will certainly be in high demand.

Minimum Entry Requirements

There are no work experience or prior qualifications required to sit for the SCR exam. Hence, this will be the same to take this preparation course. However, course participants are generally expected to have general proficiency in the English language, and a basic degree/diploma (in any subject) at the university/college/polytechnic level.

Program Date and Learning Format

17 Feb 2024 Saturday, 9-12pm, and 1:30-4:30pm

24 Feb 2024 Saturday, 9-12pm, and 1:30-4:30pm

2 Mar 2024 Saturday, 9-12pm

9 Mar 2024 Saturday, 9-12pm, and 1:30-4:30pm

13 Mar 2024, Wednesday, 7-8pm (1 hour online exam)

There will be a mini quiz at the end of the program. However, passing the RMI quiz would not guarantee that candidates could pass the Global Association of Risk Professionals' (GARP) SCR certification exam nor would it provide the candidate with the Sustainability and Climate Risk (SCR) Certificate. The GARP certification exam is not part of this course and exam fees are excluded.

SSG Funding (S$, subject to prevailing GST)

This program is eligible for SkillsFuture Singapore (SSG) funding claims subject to all eligibility criteria being met. (GST listed at 9%)

Sustainability and Climate Risk Certification Training Program (Synchronous e-learning)

| Funding Type | Full Programme Fee | SSG Grant Amount | Nett Programme Fee | GST On Nett Programme Fee | Total Nett Programme Fee | Less Additional Funding | Total Nett Fee Payable |

| Enhanced Training Support for SMEs | 3300 | 2310 | 990 | 89.10 | 1079.10 | 660 | 419.10 |

| Singapore Citizens - 40 years old or older (MCES) | 3300 | 2310 | 990 | 89.10 | 1079.10 | 660 | 419.10 |

| Singapore Citizens - 39 years old or younger | 3300 | 2310 | 990 | 89.10 | 1079.10 | 0 | 1079.10 |

| Singapore PRs | 3300 | 2310 | 990 | 89.10 | 1079.10 | 0 | 1079.10 |

| International Participants | 3300 | 0 | 3300 | 297 | 3597 | 0 | 3597 |

1All self-sponsored Singaporeans aged 25 and above can use their SkillsFuture Credit to pay for the program. Click here to view the program (Course Reference Number: TGS-2023038124).

2Mid-Career Enhanced Subsidy (MCES) - Singapore Citizens aged 40 and above may enjoy subsidies of up to 90% of course fees. MCES subsidy applies if you turn 40 on the year that you take the course, even if the course is completed on or before your birthday. More info.

3Enhanced Training Support for SMEs (ETSS) - SME-sponsored employees (Singaporean Citizens and PRs) may enjoy subsidies up to 90% of the program fee. More info.

4Eligible organisations (excluding government entities) may apply for the absentee payroll funding via SkillsConnect for Singaporean/permanent resident participants attending the program during working hours. The absentee payroll funding is computed at 80% of hourly basic salary capped at $4.50 per hour or $7.50 per hour for SME. More info.

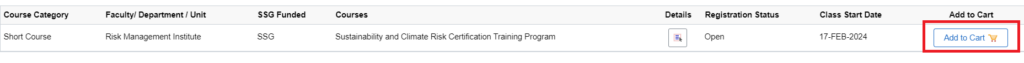

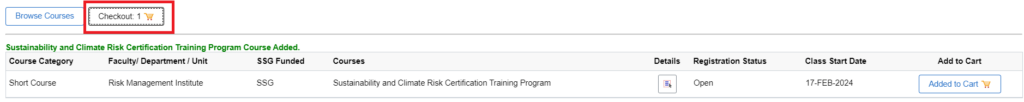

Registration

Click on the FAQs button for the registration guide.

For enquiry, please contact rmitraining@nus.edu.sg

Frequently Asked Questions

Required Disclaimer

GARP does not endorse, promote, review or warrant the accuracy of the products or services offered by Risk Management Institute, National University of Singapore of GARP related information, nor does it endorse any pass rates claimed by the Exam Prep Provider. Further, GARP is not responsible for any fees or costs paid by the user to Risk Management Institute, National University of Singapore, nor is GARP responsible for any fees or costs of any person or entity providing any services to Risk Management Institute, National University of Singapore. ERP®, FRM®, GARP® and Global Association of Risk Professionals™, ICBRR® and FRB™ are trademarks owned by the Global Association of Risk Professionals, Inc.