Risk Management Strategy – Navigating Risk in Volatile Times (Postponed)

25 - 26 March 2024

Risk Management Strategy – Navigating Risk in Volatile Times (Postponed)

Course Synopsis

Effective risk management is crucial for the sustainable growth and success of small and medium-sized enterprises (SMEs). It is an essential practice for SMEs to navigate uncertainties and protect assets. This two-day workshop on Risk Management for SMEs aims to equip participants with the knowledge and practical skills needed to implement a robust risk management program tailored to the unique needs of SMEs. Attendees will learn the fundamentals of risk identification, assessment, and mitigation while understanding the significance of embedding risk management into the organization's culture. Through interactive discussions, case studies, and hands-on exercises, participants will gain valuable insights into building a proactive risk management framework to protect their businesses from potential threats and capitalize on opportunities for growth. By the end of the course, participants will be equipped to proactively manage risks and make informed decisions that drive success for their SMEs.

Key Learning Objectives

- Establish a common understanding of risk management concepts and terminology as part of a common language aligned to industry practice.

- Understand the importance of risk management for SMEs and its impact on business resilience and growth.

- Identify and categorize common risks faced by SMEs, including financial, operational, strategic, and compliance risks.

- Learn effective risk assessment techniques to prioritize risks based on severity and likelihood.

- Develop risk mitigation strategies and action plans to address identified risks.

- Integrate risk management principles into the organization's culture and decision-making processes.

- Establish a robust risk monitoring and review system for continuous improvement.

- Implement governance and regulatory compliance measures to mitigate legal risks.

- Enhance financial risk management strategies to safeguard the SME's financial stability.

- Demonstrate an understanding of the inter-relationship of key risk and common controls.

Target Audience

Business owners, SME senior management, line managers and operators who are engaged in or are likely to be engaged in risk management activities in the course of their business.

Participants should preferably:

- Have at least 3 years of working experience or start-up experience

- In leadership roles in organisation

- Be familiar with governance and compliance

- Be familiar with business risks

Program Structure

Day 1:

Introduction to Risk Management for SMEs

- Importance of risk management for SMEs' success and sustainability

- Overview of key risk management principles, frameworks and best practices

- Identifying the unique risk challenges faced by SMEs

Risk Identification and Categorization

- Techniques for identifying and categorizing risks in SMEs

- Understanding financial, operational, strategic, and compliance risks

- Developing risk registers and risk profiles for SMEs

Risk Assessment and Prioritization

- Conducting risk assessments and measurements using qualitative and quantitative methods

- Prioritizing risks based on their potential impact and likelihood

- Identifying critical risks that require immediate attention

- Conducting periodic risk assessments and program reviews

Risk Mitigation and Action Planning

- Developing risk mitigation strategies and action plans

- Implementing risk response strategies to address identified risks

- Integrating risk management with the SME's strategic planning process

Day 2:

Embedding a Risk-Awareness Culture

- Fostering a risk-aware culture within the SME and its workforce

- Encouraging proactive risk reporting and communication

- Training employees on risk management practices and responsibilities

Governance and Regulatory Compliance

- Understanding the governance and regulatory landscape for SMEs

- Identifying relevant governance, regulations, and industry standards

- Developing compliance programs to mitigate governance and compliance risks

Introduction to Financial Risk Management for SMEs

- Identifying and managing financial risks (e.g., liquidity, credit, market risks)

- Assessing financial risk exposure and determining risk tolerance levels using business ratios

Risk Monitoring and Review

- Establishing key performance indicators (KPIs) for risk management effectiveness

- Monitoring risk indicators and early warning signals

Communicate and consult

- Escalating key risk based on trigger points

- Inter-relationship of key risks and common controls

Lecturers

Cher Shen, Chung

Director, Risk Advisory

Deloitte

Guan Seng Khoo, PhD

APAC Advisory Council Member, Singapore Economic Forum

Program Date & Venue

25-26 March 2024

Shaw Foundation Alumni House

Duration: 14 hours

Program Fee

S$1,900 (subject to 9% GST)

Note: Please hold payment/SkillsFuture Credit claims until further instructions.

SSG Funding

This program is eligible for SkillsFuture Singapore (SSG) funding claims subject to all eligibility criteria being met.

| PROGRAM: | Risk Management Strategy – Navigating Risk in Volatile Times | ||||||

|---|---|---|---|---|---|---|---|

| International Participants | Singapore Citizens1 | Singapore PRs | Enhanced Training Support for SMEs3 | ||||

| 39 years old or younger | 40 years old or older2 | ||||||

| Full Program Fee | $1,900.00 | $1,900.00 | $1,900.00 | $1,900.00 | $1,900.00 | ||

| Less: SSG Grant Amount | $0.00 | $1,330.00 | $1,330.00 | $1,330.00 | $1,330.00 | ||

| Nett Program Fee | $1,900.00 | $570.00 | $570.00 | $570.00 | $570.00 | ||

| 9% GST on Nett Program Fee | $171.00 | $51.30 | $51.30 | $51.30 | $51.30 | ||

| Total Nett Program Fee Payable, Including GST | $2,071.00 | $621.30 | $621.30 | $621.30 | $621.30 | ||

| Less Additional Funding if Eligible Under Various Schemes | $0.00 | $0.00 | $380.00 | $0.00 | $380.00 | ||

| Total Nett Program Fee Payable, Including GST, after additional funding from the various funding schemes | $2,071.00 | $621.30 | $241.30 | $621.30 | $241.30 | ||

1All self-sponsored Singaporeans aged 25 and above can use their SkillsFuture Credit to pay for the program. Click here to view the program (Course Reference Number: TGS-2023040121).

2Mid-Career Enhanced Subsidy (MCES) - Singapore Citizens aged 40 and above may enjoy subsidies of up to 90% of course fees. MCES subsidy applies if you turn 40 on the year that you take the course, even if the course is completed on or before your birthday. More info.

3Enhanced Training Support for SMEs (ETSS) - SME-sponsored employees (Singaporean Citizens and PRs) may enjoy subsidies up to 90% of the program fee. More info.

Registration

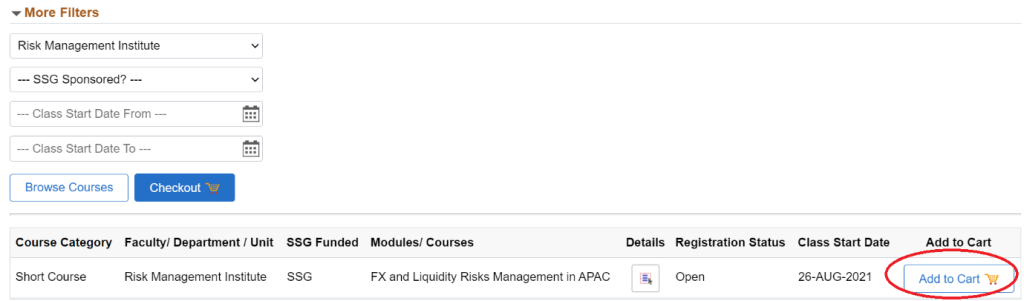

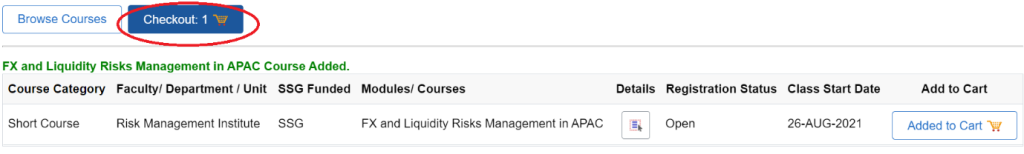

Frequently Asked Questions

For enquiry, please contact rmitraining@nus.edu.sg